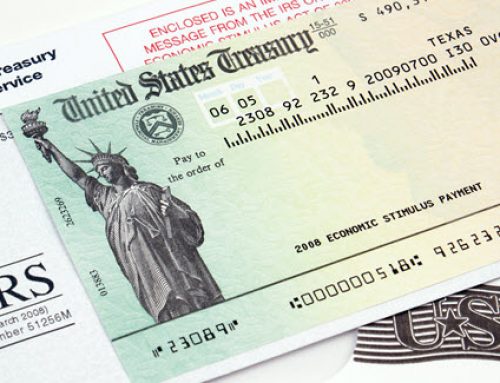

The United States Social Security Disability Insurance program, which provides benefits to over 11 million Americans, could be cut by nearly 20 percent. According to reports from the Social Security Administration Board of Trustees released in July 2014, the Social Security trust fund, which finances the federal program, is projected to be depleted by the end of 2016.

To address potential shortfalls in the past, Congress has reallocated payroll taxes from Social Security’s Old Age and Survivors Insurance fund to the disability trust. Similarly, while recognizing the need for a congressionally crafted long-term solution, the White House has proposed reallocating payroll taxes from the social security retirement fund to the social security disability trust fund to prevent the looming depletion.

Specifically, the White House’s proposal would shift $330 billion from retirement accounts over the next five years. However, according to the White House, the proposed reallocation will not affect the overall health of the retirement and disability trust funds on a combined basis. It is important to note that it is still unclear whether such measures will be adopted.

If you or a loved one have any questions regarding your Workers’ Compensation, social security, or New York State disability benefits, contact our experienced attorneys at McIntyre, Donohue, Accardi, Salmonson & Riordan, LLP. For a consultation, call (866)557-7500.

Attorney Advertising.

Leave A Comment